Share the page

Agence Française de Développement issues a €1.5 billion 2.750% RegS Sustainable benchmark due 30th September 2030

Published on

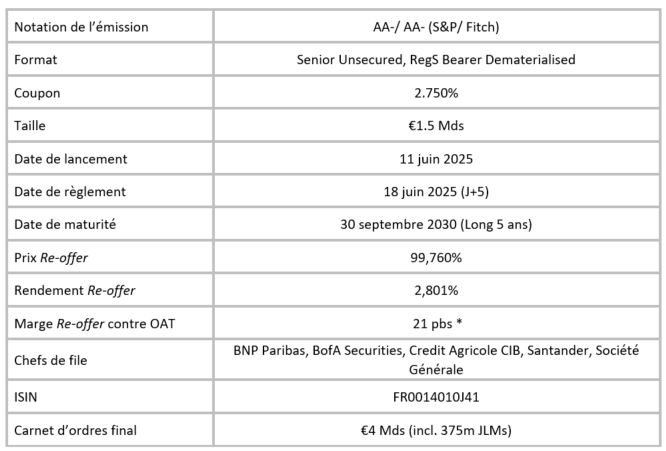

On Wednesday June 11th, Agence Française de Développement (AFD), rated AA- / AA- (S&P / Fitch) (Negative / Negative) issued a new €1.5 billion Sustainable benchmark bond maturing on September 30th, 2030.

Key Takeaways

- On Wednesday June 11th, Agence Française de Développement (AFD), rated AA- / AA- (S&P / Fitch) (Negative / Negative) issued a new €1.5 billion Sustainable benchmark bond maturing on September 30th, 2030.

- The transaction represents AFD’s third EUR benchmark of the year as well as first 5-year Euro bond for the issuer since February 2020.

- The new €1.5 billion Long 5-year bond offers a yield of 2.801%, equivalent to a spread of 21bps over the interpolated French curve (OAT 2.50% 05/25/30 & OAT 0.00% 11/25/30).

- The joint lead managers on this transaction were BNP Paribas, BofA Securities, Crédit Agricole CIB, Santander and Société Générale.

- Including this transaction, AFD has issued a total of €6.4bn equiv. in 2025, 73% of which via SDG format.

Transaction Timeline

- Amidst a busy primary market supported by constructive sentiment and decreasing volatility, AFD seized a two-day execution window post Monday’s bank holiday across several European countries, announcing the mandate for a EUR 5-year Sustainable transaction at 11:30 CET on Tuesday June 10th.

- Books formally opened on Wednesday June 11th, with initial guidance released at 09:00 CET at OAT+24bps area over the interpolated French curve.

- The transaction garnered constructive investor interest, with books over €3.25 billion (incl. 375 million JLMs) within the first two hours of bookbuilding. The strong momentum enabled the AFD to set spread 3bps inside guidance, at OAT+21bps at 10.50 CET.

- Despite the 3bps tightening, investors demand kept growing, enabling the issuer to send the final terms at 11:50 CET with a size of €1.5 billion. Final orderbook closed in excess of €4 billion (incl. 375 million JLM).

- The transaction priced at 14:03 CET with a coupon, of 2.750%, a re-offer yield of 2.801% and a re-offer spread of 21bps over the interpolated OAT curve.

“We are truly delighted to have successfully issued this 5yr transaction, a tenor in which AFD had not been present since 2020. The market environment, characterized by contained volatility, gave us a solid window to issue in favorable conditions. Our comeback to this tenor has been welcomed very positively by investors, whom we would like to thank for their renewed trust.”

Thibaut Makarovsky, Head of Financing and Market Operations at AFD

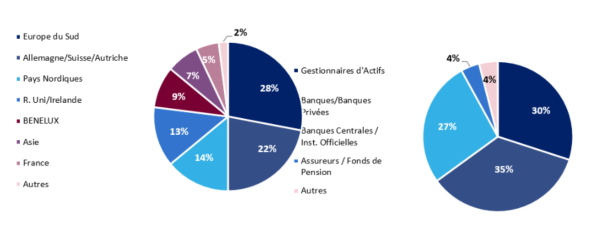

Investor Distribution

By Geography By Investor Type

* Over the interpolated French curve (OAT 2.50% 05/25/30 & OAT 0.00% 11/25/30)